Playing with FIRE

Back in late February when I flew out to Portland, OR to film my small part in the upcoming documentary “Playing with FIRE” Producer Scott Rieckens picked me up and whisked me off to dinner. Joining us were his lovely wife and Co-Producer Taylor, Director Travis Shakespeare and JD Roth of Get Rich Slowly and his lovely girlfriend Kim.

Deep into a fine meal and better conversation, looking around the table, it occurred to me that these people, my friends, my connection to this film, are all Chautauqua alums.

JD Roth was a speaker at the very first Chautauqua in 2013. Travis came as an attendee a couple of years later. Scott and Taylor were attendees in Ecuador just last year.

But the connections don’t stop there.

Kristy and Bryce are both part of this film and she was a Chautauqua speaker last year both in Ecuador and in the UK. She will be again for both weeks this year in Greece.

Millennial Revolution talks Playing with FIRE

Mr. 1500 Days is also in the film. He was a Chautauqua attendee a couple of years back and will be a speaker this year in Greece.

As is Paula Pant of Afford Anything. Chautauqua speaker in Ecuador.

So too, Jonathan and Brad of ChooseFI. Co-Speakers in Greece this year.

ChooseFI interviews Scott on Playing with FIRE

No FI documentary would be complete without a Mad Fientist. Chautauqua Ecuador speaker 4 years running.

And, of course, Mr. Money Mustache himself. In the film and a speaker at the very first Chautauqua, and back for four consecutive years after that.

The connections are so stunning, you’d be forgiven for suspecting I handled the film’s casting. Not so. Indeed I had no idea who else would be in it until shortly before my own filming, and there are several cast members who have not (yet?) been attendees or speakers at a Chautauqua.

My “Talk at Google”

People who attend Chautauqua rave mostly about the other great Chautauquans they get to meet and hang out with, and these meetings often lead to lasting friendships and unexpected opportunities. Me, too, as you can tell from the Playing with FIRE story above.

One of the keys to this dynamic is that we intentionally limit to number of attendees to ~25 and no more than 30 at the outside. My personal goal is to have at least one personal conversation with every single attendee.

Last year in Ecuador, on the last full day, fortunately for me, a woman named Rachel came up and said: “The week is almost over and we haven’t had a chance to talk. Can we sit together at dinner?”

We did and had a blast together. I often think of how close I came to missing the opportunity to know this remarkable woman.

Other than a great time over dinner and a lot of laughter, I had no expectations. But Rachel works for Google and a couple of months later she invited me to give a “Talk at Google”. Plus lunch and a tour followed by drinks at a local dive and dinner at a Chicago neighborhood joint? Sign me up! Jane and Jessica included too.

It was great fun, and the results are OK too I’m told. You be the judge:

…and a few others

All of us who have been, have had these experiences; indeed the fact that Alan and Katie** now run Chautauqua in Europe is a great example.

They came to Ecuador as attendees in 2016. They run the amazing and life changing PopUp Business School in the UK.

By the end of the week we were friends. As Alan was about to board the bus to the airport for the trip home, I pulled him aside.

“I want to put a bug in your ear,” I said. “You don’t have to answer now. Think about it a week or two and then let me know. What would you and Katie think about pulling together a Chautauqua UK?”

Without pause, he said “We’re going to do it!” Without another word, he turned around and got on the bus

That was in October 2016. August 2017 =

*****************************

Lysh and Kevin joined us in 2016 and went on the write The Ballad of Chautauqua which they preformed live for me during a visit to their HorseShoe Lounge in southern Ohio:

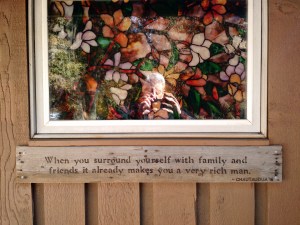

Lysh also has a side hustle, RusticLudlow, crafting burned wood plaques. She gifted me with the one below that is a line from the ballad. It now sits under that window by the front door to greet all who visit Kibanda.

(not work or kid friendly)

Directed, filmed and edited by:

Joan @ Meister’s Balogna

Brian @ Inner Parakeet

*****************************

Of course, the connections extend beyond those met at Chautauqua to those they know.

During a visit, my pal Mr. 1500 gave me a copy of Scott Trench’s fine book:

Turns out his wife, Mindy, and Scott both work for Bigger Pockets and one of the things they do there is to host the Bigger Pockets Podcast. Those connections led to the…

Bigger Pockets Podcast: JL Collins edition

…and Mindy will be joining us for Chautauqua Greece.

*****************************

When I was first crafting the concept of Chautauqua my goals were simple: Travel to an exotic place, hang out with interesting people, talk about cool stuff. Alan has since added, and eat too much great food.

I never dreamed it would bring into my life so many lasting friendships and opportunities.

My intention with this post has been to share with you some of those. I hope you enjoy them. But if this post has also inspired you to add Chautauqua to your plans, for this year at least, I apologize.

Both weeks for Greece sold out have long been sold out. However, please feel free to put yourself on the:

Millennial Revolution — Chautauqua: Come Join the Family (This is a brilliant post with all the details!)

1500 Days to Freedom — Meet some awesome people… (Another brilliant post, this one with dinosaurs!)

ChooseFI — Oh, the Places we will go Chautauqua in the words of the speakers who will be in Greece. There is nothing quite like hearing the voices behind the words.

Also, be sure to listen to this incredible episode with Travis Shakespeare. Travis is a master story teller and, among other things, he shares three:

- How the FI movement fits into the cultural fabric of America and its traditions of rugged individuals charting their own course.

- The coming Playing with FIRE documentary

- How he decided to come to Chautauqua and what it has meant to him. One of the best insights I’ve heard or read yet.

Mad Fientist — Money Talks panel discussion at Chautauqua UK Attendees discussing FI and also a great inside look at the Chautauqua experience.

JL Collins — Greece 2018 Mount Olympus

******************************************************

**Alan recently introduced me to my new favorite expression:

Throwing my toys out of my pram

The moment I heard it, I knew instantly what it meant. It is just so damn descriptive. As in…

******************************************************

Every now and again I get a comment on an old post. It is always nice to see those getting some attention and it is fun, for me anyway, to re-read them. Maybe you too. Here’s one:

Case Study #10: Should Josiah buy his parents a house?

******************************************************