Your current allocations

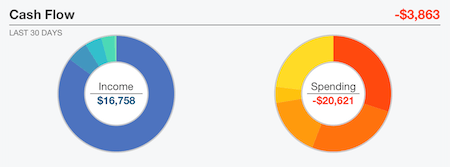

Cash Flow

Retirement Planning

Note: The above illustrations are all courtesy of Empower, from their website and are not from an actual client account.

At a glance now you’ll see what’s working and what you might want to change. As I say, very cool.

So what’s the catch?

Skeptic that you are (or should be) right about now you’re thinking:

“If this is all free, how do they make their money?”

Boy howdy! You sound like me!

This is a lot of cool and sophisticated stuff to provide for free and around here we know even we can be conned. When offered free stuff, it always pays to understand how the money flows. While my pals had already filled me in, this still was one of the key questions I had when I met with them at FinCon (see Sidebar below). Nothing like hearing it personally.

Turns out they are also financial advisors and several buttons on their site will direct you to this service. So what is happening here is, by offering these tools, they are also collecting data and in the process cultivating a very clean prospect list for their services. If your assets are large enough they will reach out to you and offer to sign you up.

My independent sources who have experienced this assure me it is very low key and low pressure. They don’t want to alienate anyone. The thinking is that as people get used to using their tools over the years, should they ever decide to engage professional guidance, Empower will be the first in mind and the “go to” place. Seems a smart approach to me.

Meanwhile you can happily use the free tools and ignore the advisory service for as long as you like.

So should you use their advisory service?

Well, the the annual fees are:

.89% for portfolios up to $1 million and then…

- .79% for the first $3 million

- .69% for the next $2 million

- .59% for the next $5 million

- .49% over $10 million

Let’s look at it this way:

- If you are coming from a traditional advisor and paying upwards of 1% a year, Empower looks very good and is worth your serious consideration. Especially if you find value in personal attention.

- If you just want some guidance setting your asset allocation and rebalancing it automatically, Betterment is a less expensive option and worth a look.

- If you have read the Stock Series here and are comfortable with what you’ve learned, you should be able to handle this yourself. Go directly to Vanguard and their low-cost index funds. This is your least expensive option and at a million plus invested you’ll even qualify for their Flagship Service and some personal guidance.

********************************************************************

Note:

This was Part I of a post that originally included two parts, the second being on how to unload your unwanted stocks and funds. Since they both deserve an update and second look, and since I thought them more useful separated, here you are. If you are interested, this is the original.

********************************************************************

Addendum: May 9, 2018

In the comments on the original post, reader Dave provides an excellent update mini-review on Empower

Addendum:

From Firecracker in the comments below…

Empower

If you have come here, read through the Stock Series and decided the simple low-cost approach described makes sense, you are now faced with the problem of how do you get from where you are to where you want to be. That is, what do you do with all the investments you already have? How, exactly, do you move from point “A” to point “B”?

If you are like many readers, you’ve come to this blog having already spent years, maybe even decades, investing. You very likely have a wide range of stocks and/or funds that seemed like a good idea at the time but now, maybe not so much. In my next post we’ll talk about how to unload those unwanted stocks and funds.

But the first order of business is to get a grasp on exactly what you currently own, what it is costing you in fees and how/if it might fit into your new and future plans.

You may already have this well organized and at your fingertips. If so, well done and you can skip ahead to the post How to unload your unwanted stocks and funds.

If not, you’ll probably want to use one of the on-line tools out there. Empower (previously Personal Capital) is the coolest I’ve seen and one of the easiest to use. Plus, it is FREE.

For those reasons, it is the one I recommend and it is one of only four affiliates I’ve accepted here on the blog. What that means is, if you choose to use it, this blog will earn a commission.

To use Empower‘s free tools, click on the link and log in. Next you’ll enter your investments and bank accounts. While I don’t use Mint, some of my FI friends tell me entering your data into PC is even easier.

Once your info is entered, you’ll be able to keep track of all your accounts and the data will be updated automatically. You can even enter any paintings, antiques, jewelry and/or any other valuables you might own. Of course with those you’ll have to decide on their value and it won’t be automatically updated.

Your PC dashboard then automates your net worth calculation and updates every time you log in on your desktop, phone or tablet.

Once you are done, assuming you’ve entered everything correctly, you’ll have complete handle on your financial situation:

Net Worth

Fees on your funds