Cat food. It’s what’s for dinner.

Back in the early 1980s I remember railing against Social Security to my mother who was on it. She’d grown up with the specter of little old ladies living on cat food. That was a real possibility when she was a girl and the elderly were the poorest group in America. I explained to her that if I and my two sisters were let off the SS hook we could not only give mom more than her monthly check, we’d have extra left to feather our own nests. She wasn’t buying it.

And I wasn’t buying it, either. I never figured Social Security would be there for me. All my financial planning has been based on the idea that if it wasn’t, no problem. If it was, that would be a pleasant surprise. Well, Surprise! Now I’m just a few short years from collecting and a surprisingly hefty amount at that. Considering what we’ve paid in and assuming we live long enough, it turns out to be a pretty sweet deal. I hadn’t counted on the power of the AARP: The most formidable lobby in history.

No cat food for these folks.

Us geezers are now the wealthiest group in America.

A little bit of history.

Social Security was born in 1935 during the depths of the Great Depression. Those hard times devastated everybody, but none more perhaps than the elderly who were no longer able to work even in the unlikely event work might be found. Many were literally living on cat food, if that could be had.

Back in those days, life expectancies were considerably less. Now figuring this can be tricky as the biggest reducer of average life expectancy is deaths in childhood. But if we look at the life expectancies of people who have survived to the age of 20, we get a more useful number. In 1935, for men the average was around 65, for women about 68. Since then, life expectancy in the USA has continued to expand. Here’s a cool tool for looking at this: Expanding Life Expectancies

From those numbers it’s easy to see that setting the age to collect Social Security at 65 was a pretty good bet for the system. All workers would pay in, relatively few would live long enough to collect and then only for a few years. This worked so well, in fact, (with some fairly minor adjustments along the way) that it was only around 2011 that the money flowing in stopped being more than the money being paid out. So well the total surplus is currently around 2.7 trillion dollars. (Update: As of September 2018 it is now 2.9 trillion) (Drifted down to 2.83 trillion as of 2022)

The times they are a changin’.

But now the wheel has turned. The huge baby boom generation that has been paying in these surpluses has begun to retire. In addition, they are living a whole lot longer. Going forward, if nothing changes, the system will be paying out a whole lot more than it takes in. It looks like this:

1935-2011: Annual surpluses build and end up totaling about 2.7 trillion.

2012-2021: Annual payroll taxes fall short of the annual payouts. But the ~4.4% interest on the 2.7T will cover the gap.

2021-2033: The interest payments will no longer be enough to make up the payout difference and we’ll start drawing down on the 2.7T.

2033: The 2.7T is gone.

After 2033: The payroll taxes then collected will only be enough to cover 75% of the benefits then scheduled to be paid out.

Where exactly is this 2.7T?

The 2.7 trillion dollar surplus is commonly referred to as the Trust Fund and it is held in US Treasury Bonds. This, by the way, is about 16% of the roughly 16 trillion-dollar (Now ~22 trillion as of 2018, five years later) US debt. In a real sense we owe it to ourselves. In fact, about 29% (4.63T) of our 16T debt is owed to ourselves in this fashion: Social Security, Medicare and the balance in Military and Civil Service Retirement programs. Only 1.1T/8.2% is owed to China, the creditor we hear most about. We owe Japan about the same. If you’re curious, here’s a breakout: http://www.mygovcost.org/2012/09/16/who-owns-the-u-s-national-debt-summer-2012-edition/

Does this 2.7T really even exist?

You’ve probably heard scary talk that this Trust Fund doesn’t really exist. That the government has already spent the money. Well, yes and no.

There is no “lock box” somewhere stuffed with these:

$1000 bill

Or these:

$5000 bill

Or these:

$10,000 bill

Or even these:

$100,000 bill

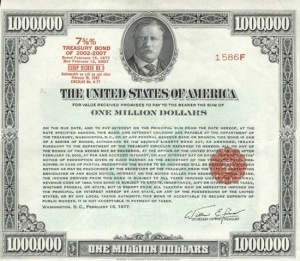

It is in a whole bunch of these:

US Treasury Bond

*For bonus points, can you name the guys on those bills? Without consulting your Uncle Internet?

To answer the question, “Is the money really there?” you need to understand a bit about what bonds are and how they work.

Anytime any entity sells a bond it is to raise money it intends to spend. The bond and its interest are then paid back with future revenues. This is how bonds work. As it happens US Treasury Bonds, what the Trust Fund holds, are considered the safest investments in the world. Backed, as the saying goes, by “the full faith and credit of the United States Government.” Of course, that’s us, the US taxpayers and the same folks owed most of the 2.7T.

So the US Treasury Bonds held by the Trust Fund are real things with real value. Just like the US Treasury Bonds held by the Chinese, the Japanese, numerous bond and money market funds and countless numbers of individual investors.

Yeah, well I’d still feel better if they hadn’t spent the money I contributed and if it really was cold hard cash in a lock box I could draw on.

Well, OK, but cash is a really lousy way to hold money long-term. Little by little it gets destroyed by inflation.

It is important to understand that any time you invest money, that money gets spent. If you hold a savings account at your local bank, your money isn’t just sitting in a vault. The bank has lent it out and is earning interest on it. A portion of that is the interest they pay you. Federal law does require that banks hold a portion of deposits as cash “in reserve” to be able to pay depositors upon demand. If that demand exceeds the reserve, what is commonly called “a run on the bank” occurs. Because most of it has been lent out and is not instantly available.

If that is an unacceptable risk, your alternative is to stuff your cash in your mattress or (much better) a safe deposit box. Had the government done that, the Trust Fund would now be overflowing with currency. That is, pieces of paper money backed by, you guessed it, “the full faith and credit of the United States Government.”

At least the Treasury Bonds pay interest.

When should I begin taking the money?

Once you reach age 62, you can begin receiving Social Security. The catch is, the sooner you start, the smaller your checks. The longer you delay (up until age 70), the bigger the check. Of course, the longer you delay the fewer the years you’ll be collecting.

Countless articles have been written about strategies attempting to answer the question as to when to begin receiving benefits. All kinds of fancy, sometimes complex strategies, are described. I’ve read a bunch and my view is in the end it’s really pretty simple: Since the government actuarial tables are as good as they get, the payments are pretty much spot on with the odds. Here’s what, in order, you have to ask yourself:

1. When do I need the money? If you genuinely need the money right now, nothing else matters. But if you can delay you might find some advantages.

2. Do you think Social Security will collapse and stop paying? If you believe this, clearly you’ll want to collect while the collecting is good. For what it’s worth, I happen to think you’re wrong and I’ll explain why further on.

3. How long are you going to live? The longer you live, the more advantageous delaying is. The break even point between age 62 and 66 is around age 82-85. If you think you’ll die before then, you might want to take the money sooner.

4. Unless you are married and you were the higher earning spouse. Then you also want to consider how long your spouse will live. If your spouse is likely to outlive you, upon your passing he/she will be able to trade in their lower SS payments for your bigger checks.

For example, my wife and I are both in good health. But looking at family histories, and because women outlive men, my best guess is that she’ll survive me. Maybe by as much as two decades. I figure I’m good to maybe 80-85. Were I alone, I’d start drawing ASAP. But she could easily see 95 or 100. When I die she’ll have the option of switching from her benefit to mine. Since mine will be larger, that’s what she’ll do. To maximize that check for her, I’ll delay taking my benefit until I’m 70. She’ll start hers at 66.*

*(2023 update: My wife and I are now drawing SS and have done exactly this. It has worked out well so far)

Another thing worth considering: As we reach advanced age our mental acuity diminishes. Managing our investments becomes harder. We become more reliant on others. At that point, a monthly government check has more value than just the dollars.

Of course there’s no way to know what the future really holds. The best we can do is play the odds.

The odds look to me like Social Security is doomed. I’m taking mine ASAP.

There are those who choose to take their benefits the moment they turn 62, even though the amount is reduced. Some simply need the money right now and have no choice. But others are acting out of fear. They believe Social Security will collapse in their lifetime and they want to get what they can while they can. I’m not worried. If you are 55 or older you’ll collect every dime. Here’s why:

1. Social Security is backed by the most powerful lobby in history: AARP.

2. Geezers are an increasing proportion of the population.

3. Geezers vote.

4. Politicians rarely try to take anything away from a large population that votes.

5. This is why all the possible solutions being suggested will affect only those age 55 and under.

Well that’s all well and good, but I’m under age 55! What about me?

For anyone 55 and over, Social Security has turned out to be a pretty great deal. But mine and the generations older than I are likely the last that will enjoy such lofty benefits. The system is in trouble and clearly changes will have to be made. For those under 55 today the deal is likely to be a lot less sweet. You can expect:

- To get 100% of any promised benefits, but the promises will be smaller.

- It will cost you more. Income caps (the amount of your income subject to SS tax) will continue to be raised. In 2003 the cap was $87,000. For 2013 it is $113,700. (As of 2020: $137,700) That’s a trend that will continue.*

- The “full retirement age” will continue to rise. It used to be 65. For me it’s 66. For anybody born in 1960 or later it is 67. Those ages will continue to rise.

- Benefits may become “means tested.” That is, based on your need rather than what you paid in.*

- Your benefit will be subject to income tax, if your income is over a certain amount. In 2020 for Singles this begins over $25,000. For Married Filing Jointly: over $34,000.

- Congress will continue to tinker and in the end Social Security will still be there.

*2023 updates:

2. The discussion now is tilting to removing the caps altogether and subjecting all income to the SS tax.

4. If you and young and follow the advice on this blog and become very wealthy, there is a growing chance your benefit will be means tested away entirely.

Both #2 & #4 represent a fundamental shift in the nature of Social Security, changing it from a forced retirement program where your checks are based on your contributions to a social welfare program where your checks are based on your need. How you feel about this will depend on your political persuasion but either way, in my view, this philosophical shift should have a more prominent role in the debate.

So, is Social Security a good deal?

Well, it kinda depends. For the fiscally responsible types who read this blog, probably not. If you took that 6.2% of your income you are compelled to contribute, along with the 6.2% your employer is compelled to kick in, and invested it over the decades using the strategies presented here, you’d likely be far, far ahead. Plus your money would be in your hands and not subject to the whims of the government. But that’s just the few of us.

I’m realistic enough to know most people are goofs with their money. Without Social Security many would be back to living on cat food. Not only would the rest of us have to read about their sad plight, something much more draconian than Social Security might well be implemented to remedy the situation. So, yes, for most people it will turn out to be a good deal. And probably for society as a whole. But not for you. Or me.

**************************************************

Recommendation

Plan your financial future assuming Social Security will NOT be there for you. Live below your means, invest the surplus, avoid debt and accumulate F-You Money. Be independent, financially and otherwise. If/when Social Security comes through, enjoy.

**************************************************

Want to know where you personally stand with Social Security right now?

What’s your Social Security break-even age?

**************************************************

Addendum 1:

In our comments conversation here, Stocks Part VIII: Withdrawal Rates, Reader jcw provided two very useful additional links for married couples: A calculator for figuring when and how best to take benefits and an article on how to Maximize Joint Benefits.

Addendum 2:

Here’s a great post from Go Curry Cracker debunking the Social Security Torpedo.

**************************************************

*As for those guys on the currency:

$1000: Grover Cleveland

$5000: James Madison

$10,000: Salmon P. Chase**

$100,000: Woodrow Wilson

Oh, and that’s Teddy Roosevelt on the $1,000,000 Treasury Bond.

**Chase is one of three guys on US currency who was not President. He was a Senator, OH State Governor, US Treasury Secretary for Abraham Lincoln (probably tough years to have that job) and Chief Justice of the US Supreme Court. But never President. The slacker.