Regular readers know the story.

This blog launched in 2011 at the suggestion of a business colleague of mine. I had shared with him letters and notes I had been writing to my daughter, mostly about money and investing.

One of my core beliefs is that, in this complex world we have created, money is perhaps our most powerful tool. Learn to master it and the world opens before you and the path becomes smooth. Ignore it and the way is littered with jagged stones, sharp thorns and dark, deep pits.

“This is pretty useful stuff,” he said. “You should create a blog and share it with your family and friends.”

While I knew, vaguely, what a blog was I had never actually looked at one before. I joke, but it is true, that the first blog post I ever read was the first blog post I ever wrote.

Not surprisingly, few of those family and friends bothered to give it more than a cursory glance. Turns out those interested in what has come to be called Financial Independence are as “rare as baptized rattlesnakes” to draw a phrase from what might well be my all time favorite novel:

What was surprising was that the blog began to attract a readership beyond my little circle. Over the years what began slowly started to expand rather dramatically, just like…

Then, even more surprisingly (at least to me) it began to develop an international readership. In the spring of 2012 I wrote this post asking readers…

Checking today, almost 25% of the page views here are coming from countries outside The United States.

As wonderful and satisfying to me as this is, it does present a bit of a dilemma. What I know about is investing in The United States and, while my critics might suggest otherwise, I try to write only about what I know. I haven’t a clue as to how to implement the strategies I present here outside the US.

Fortunately, this increasing international readership introduced me to people who do. Mrs. EconoWiser was one and at my request in 2014 she wrote for us here…

Investing in Vanguard for Europeans

This post was warmly received and the comment section has become a forum where readers from all over the world share their thoughts, approaches, ideas and success.

As we enter 2018, the time seems right to give my international readers some focused attention again.

You’ll note as you read today’s guest post, The Escape Artist and I are not entirely on the same page when it comes to fund choices. And that’s just fine. I don’t invest in Bitcoins or plan to embrace the Wasting Asset Retirement Model either, yet both are guest posts here.

But our basic philosophies are very much aligned. As for the differences, you can decide for yourself what best resonates with you.

With pleasure I present to you…

An International Portfolio from The Escape Artist

Thanks to Morgan Housel!

Investing can be made simple enough for anyone to manage their own investments. Here’s how.

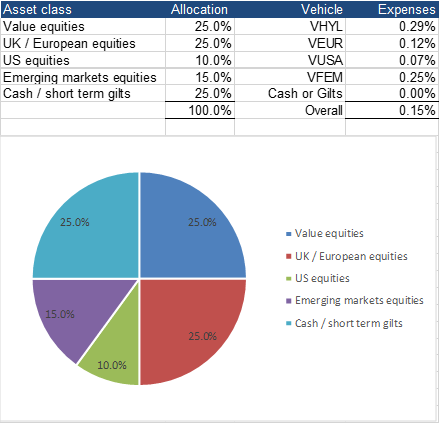

Here’s a simple example portfolio using low cost Exchange Traded Funds (ETFs) from Vanguard.

Its no harder for anyone to buy or manage than it would be to open an online bank account. Its so simple that a child could manage it themselves with minimal effort.

Why Vanguard? Because its owned by the customers. So Vanguard are the only fund management group who have no incentive to over-charge you.

Why ETFs? Because they are simple and offer the lowest ongoing fees. The ETFs are traded on the Stock Exchange and can be bought as easily as a regular share. These ETFs pay out dividend income every quarter (e.g. Mar, Jun, Sep, Dec) which can either be used for living expenses or reinvested.

The ETFs used are:

VHYL = Vanguard All-World High Dividend Yield ETF

VEUR = Vanguard FTSE Developed Europe ETF (includes UK)

VUSA = Vanguard S&P 500 ETF

VFEM = Vanguard FTSE Emerging Markets ETF

This short video from Lars Krojer makes the point nicely about how simple investing can be made. All you need is just a single all-world equity tracker fund.

[youtube https://www.youtube.com/watch?v=OaCl1QeNd6A&w=560&h=315%5D

But the reservation that I have about just chucking everything into something like the Vanguard All World ETF (VWRL) is that the US equity market looks expensive at the moment. And the USA makes up ~50% of VWRL. US small caps and tech / social media stocks look particularly pricey. Maybe for good reasons, maybe not.

One issue with index investing is that if the index is over-priced at the time of purchase, then the long term investor is doomed to underperformance. You can either ignore this and just keep on dripping money in each month, putting your investing on automatic pilot (this is often called $ / £ cost averaging).

Or you can choose to look for value. The Simplicity Portfolio seeks to overweight better value indexes and underweight over-priced indexes. I selected indexes that looked like they offered better value based on metrics like the Shiller PE, price: book value and dividend yield.

The Simplicity Portfolio currently underweights the USA on the basis that the CAPE on the S&P 500 is currently (Dec 2017) 32x, against a long run average of about 16x. So only 10% is directly allocated to the US stockmarket instead of a purely passive weighting based on market capitalisations of over 50%. For the same reason (valuation), there is no allocation to small cap equities.

With US valuations relatively high, particularly for many companies without long operating histories and track records of dividend payment (think Twitter, Facebook etc), I think its appropriate to tilt towards value as well as getting global exposure via VHYL which excludes non-dividend paying stocks. I also think its appropriate to have allocations to Europe (including the UK) and Emerging Markets, both of which trade on lower CAPEs than the US market.

Here are the allocations in The Simplicity Portfolio:

So the Simplicity Portfolio reflects current valuations. Valuation is not a reliable predictor of short term returns. In other words, shares or indexes that start cheap can, in the short term, get cheaper. And expensive assets can get more expensive. But, over the long term, lower starting valuations usually lead to higher future returns. That’s why value investing has historically provided a performance advantage.

I’ve been investing for over 20 years now and, during that time, there have always been asset classes that are popular (and relatively over-priced) and others that are unpopular (and relatively under-priced). Imagine an American High School. The popular assets are a bit like the quarterbacks and cheerleaders (popular now but doomed to future under-achievement) and the unpopular assets are a bit like the geeks (that go on to start tech companies and get rich).

Turning to asset allocation, the 75% equity exposure equates to the highest level suggested by Ben Graham in The Intelligent Investor (which Warren Buffett describes as the best book on investing ever written). With interest rates low, the opportunity cost of holding bonds or cash is high. So The Simplicity Portfolio currently maximises equity exposure subject to the 75% constraint proposed by Graham.

As Warren Buffett reminds us, the long term investor has more to fear from inflation than from equity volatility. The real value of cash is constantly being eaten away by inflation…its disappearing before your eyes like an ice sculpture at a party.

Price volatility is not the same thing as real risk. Price volatility is just numbers on a screen bobbing up and down. Real risk is something big, bad and permanent happening to your assets…which is something quite different.

Equally, many people will say having 25% in cash / short term government bonds (called gilts in the UK) represents an unacceptable drag on performance with yields so low. If you are in the wealth-building phase and can ignore equity volatility, then feel free to take your equity allocation up towards 100%.

Jim Collins, the elder statesman of US financial independence bloggers, offers a neat rule of thumb to choose an asset allocation. Jim suggests that people working towards financial independence have 100% of their portfolio in shares (plus an emergency fund of cash). Later, once you’ve quit working, you include a 25% bond / cash allocation to act as a portfolio stabiliser.

100% in equities may sound like an aggressive asset allocation but remember this is for people that are still working and saving. So, if the stockmarket crashes, they should be pleased (not scared) because they will be benefiting from £ / $ cost averaging and getting more units for their money each month.

The Simplicity Portfolio excludes gold and other commodities because I prefer to focus on wealth generating assets that pay an income and compound in value over the long term. It also excludes assets that have limited upside but are not really safe (eg corporate bonds, P2P lending etc).

The portfolio has low costs. Note the expense ratio of just 0.15% per year. This compares to typical total fees of 2.0% – 2.5% per year typical for customers of a financial adviser / wealth manager with active funds. Why give all your portfolio income away to advisers and fund managers for nothing? The simplicity portfolio costs less than 10% of these (arguably inferior and riskier) alternatives.

As I showed here, minimising fees is incredibly important due to the effects of compounding. Many people can easily save a million pounds over the course of a lifetime by reducing fund management fees. If you have an easier way to make or save an extra million pounds, then I’m all ears.

As I showed here, minimising fees is incredibly important due to the effects of compounding. Many people can easily save a million pounds over the course of a lifetime by reducing fund management fees. If you have an easier way to make or save an extra million pounds, then I’m all ears.

This is a low turnover portfolio for long term investing but all portfolios may need some change from year to year to rebalance and reallocate away from overpriced markets and towards better value alternatives. Low churn is good but complete neglect may not be. So its worth checking your asset allocation at least once a year and rebalancing if appropriate.

I’ve seen a lot of investors portfolios over the years (including many with the “benefit” of a wealth manager or financial adviser) and most of them are a mess. Most are full of historical baggage, pointless complexity and incur ridiculous fees for no good reason. The Simplicity Portfolio is simpler, lower cost and easier to run (without sacrificing expected returns) than 99% of what’s out there. Welcome to the 1%.

So that’s UK based investors sorted out. But what about international readers? Well, in the countries that provide most international readers, I’ve looked to see whether its possible to replicate The Simplicity Portfolio using the local Vanguard product range.

And, for the most part it is! The Vanguard ETF product range is available right across Western Europe. So the same ETFs that I used to construct the Simplicity Portfolio are available from Vanguard in Ireland, Germany, Finland, Switzerland, Italy, Netherlands, Belgium, Sweden, Denmark, Norway, France, Spain etc etc

Its a bit more complicated in the USA, Canada, Australia etc where the Vanguard product ranges are a bit different. But for each of those countries I had a look at the local Vanguard website and had a go at seeing how closely I could replicate The Simplicity Portfolio using only Vanguard ETFs. And here are the results:

This is provided for information and is not regulated investment advice. These are model portfolios and have not been tailored for any individual, including me. My portfolio is different, not least because it contains a large slice of actively selected shares. So think about your risk tolerance and asset allocation preferences when constructing your own portfolio.

One final word. If you are struggling to start, by all means keep it simple with a single all world ETF (or a LifeStrategy Fund in the UK). Or if you are in the US, you could just follow Jim Collins guidance and stick with VTSAX. Remember, there is no single right answer in investing. So don’t sweat the small stuff obsessing about micro differences between different Vanguard products.

The most important thing is to get started.

Further reading from The Escape Artist:

*****************************************************************************

Meet the Frugalwoods

My pal, Mrs. Frugalwoods, is publishing her new book this March. She was kind enough to let me read an advance copy and this is my take:

“A remarkable and inspirational journey, not of deprivation, but of joy, contentment, spirituality and, of course, financial independence. Along the way you’ll be inspired, and you just might see a new path for yourself.”—JL Collins, author of The Simple Path to Wealth

If you are interested in ordering an advance copy, check out her post:

*****************************************************************************